Supporting copy for the Request Service

call out button.

Request an Appointment

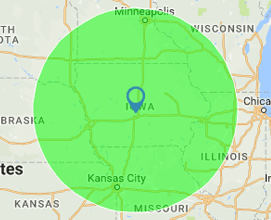

Proudly Serving Iowa, Minnesota and Nebraska

Iowa/Minnesota - 515-512-9750

Nebraska - 402-935-8098

UNIVERSAL LIFE

Request an Appointment

Proudly Serving Iowa, Nebraska, and Minnesota

Iowa / Minnesota: 515-512-9750

Iowa / Minnesota: 515-512-9750

Nebraska: 402-935-8098

Proudly Serving Iowa, Nebraska,

and Minnesota

Request an Appointment

Supporting copy for the Request Service

call out button.

FLEXIBLEUNIVERSAL LIFE COVERAGE

ADJUSTABLE BENEFITS AND A VARIETY OF USES

Life insurance is designed to provide funds to your loved ones after you die, to help them maintain their standard of living, pay your final expenses, pay off mortgage loans or other debts or to provide legacy gifts to loved ones or organizations.

Universal life insurance is a type of permanent life insurance policy with features not included in whole life or term life insurance policies. In addition to providing a death benefit, universal life insurance also provides flexible premiums, and includes a cash value savings component inside the policy. That cash value can be used for any number of reasons, such as supplementing your retirement income, paying for children's educations or any other expenses.

WHAT IS UNIVERSAL LIFE INSURANCE?

When it comes to policy flexibility, universal life insurance, or UL policies, are considered to be the most flexible kind of life insurance. Rather than simply providing a fixed death benefit amount for a fixed premium payment, UL policies offer policyholders flexibility with both their premium payments and their death benefit amount.

People who own universal life insurance policies can make periodic adjustments according to their needs. UL policies also offer a built-in cash value, so you can set money aside on a tax-deferred basis, right inside your policy.

WHY DO I NEED UNIVERSAL LIFE INSURANCE?

The reasons for buying universal life insurance are almost as varied as the number of policies available for purchase.

For most people, providing a ready source of funding for grieving loved ones after death is an important consideration. When you die, will your loved ones be able to afford to pay your final expenses and debts and be able to maintain their current standard of living? If the answer is "no", it's time to explore various life insurance options to determine what makes the most sense for your situation.

HOW DOES UNIVERSAL LIFE INSURANCE WORK?

Just like other forms of insurance, you'll need to apply for coverage and pay an initial premium. Once your policy is in-force, you'll need to make periodic premium payments to keep your life insurance benefits.

One of the best features of universal life insurance is flexibility with your premium. You can pay higher premiums to add to your policy's cash value when you're able. Or, if you need to reduce the premium for a period of time, you can make adjustments to the policy to accommodate that.

CHOOSE TRICARE FINANCIAL SERVICES FOR UNIVERSAL LIFE INSURANCE

Tricare Financial Services offers clients a different way to buy life insurance. Instead of trying to sell you on one type of insurance, one company’s policy or a specific death benefit amount, we believe it makes sense to spend some time getting to know you first. We'll ask you a series of questions to help identify what your insurance needs are and what type of coverage will best help you meet those needs. From there, we have access to a variety of insurance providers and will work to find you a policy that meets both your goals and your budget.

To learn more, and to get started with insurance quotes to protect what's most important to you, contact us to begin working with Tricare Financial Services today.

FREQUENTLY ASKED QUESTIONS

Q: WHAT ARE THE ADVANTAGES OF UNIVERSAL LIFE INSURANCE?

Universal life insurance is a popular type of policy for many reasons.

- Affordability. Universal life insurance costs less than whole-life insurance policies

- No-lapse protection. If you don't pay the premium, some types of life insurance may lapse. With universal life insurance, your policy includes some protection against lapsing by using the accumulated cash value to keep the policy in-force.

- Tax-advantaged savings. The cash value component of your universal life insurance policy provides a guaranteed minimum interest rate and offers tax-deferred accumulation.

- Premium payment flexibility. As your needs change, your universal life insurance policy premium payments and death benefits can be adjusted.

- Loan and withdrawal features. You may be able to take loans or withdrawals from the accumulated policy cash value when you need them, which may be an attractive alternative to borrowing from a financial institution.

Q: DO I QUALIFY FOR UNIVERSAL LIFE INSURANCE?

When you apply for any type of life insurance policy, you'll need to answer questions about your health, including any medical conditions you have been diagnosed with or treated for. You'll also be asked questions about your occupation and lifestyle. The insurance company evaluates this information in determining whether to approve your new insurance policy.

Many universal life insurance policies are offered with limited underwriting requirements, meaning you may not need to complete a physical examination as part of the application process.

Q: CAN I AFFORD UNIVERSAL LIFE INSURANCE?

Premiums for universal life insurance policies are typically higher than term insurance, but less than premiums for whole life insurance policies.

The price you will pay for your policy will depend on a number of factors, including the face amount of the policy (the amount of the death benefit payable after your death), your age at the time you apply, and your overall health. If you are a non-smoker, your premiums will generally be less expensive than those paid by regular tobacco users.

One of the biggest benefits of universal life insurance is the built-in flexibility when it comes to your premiums. If you experience a temporary financial hardship after your policy has been in force for a certain length of time and have sufficient cash value inside your policy, you may be able to rely on that cash value temporarily to help you keep the policy in force until you can afford to resume the full premium amount again.

Q: WHEN SHOULD I BUY UNIVERSAL LIFE INSURANCE?

Universal life insurance is a smart choice for people who want some flexibility with their life insurance policies. Because your premiums will be based on your attained age and health at the time you apply, there's no better time to apply than the present.

Call 515-512-9750

Today for Your

FREE Policy Review.

Locally Owned and Operated

Helping since 2011

Helping You Choose the Best Policy for Your Needs

Send Us a Message

Send us a message

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

About Us

Since 2011, Tricare Financial Services has been your choice for independent agents working with many different life insurance companies, so you have more options to choose from.

We only focus on life insurance and annuities. Our goal is to help you choose the best policy that suits your needs.

Service Area

Contact Us

205 Tradition Dr.

Polk City, IA 50226

Iowa / Minnesota: 515-512-9750

Nebraska: 402-935-8098

Privacy Policy

| Do Not Share My Information

| Conditions of Use

| Notice and Take Down Policy

| Website Accessibility Policy

© 2024

The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.