Supporting copy for the Request Service

call out button.

Request an Appointment

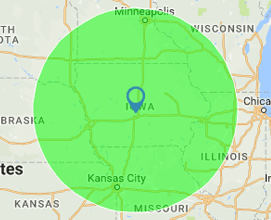

Proudly Serving Iowa, Minnesota and Nebraska

Iowa/Minnesota - 515-512-9750

Nebraska - 402-935-8098

ANNUITIES & RETIREMENT

Request an Appointment

Proudly Serving Iowa, Nebraska, and Minnesota

Iowa / Minnesota: 515-512-9750

Iowa / Minnesota: 515-512-9750

Nebraska: 402-935-8098

Proudly Serving Iowa, Nebraska,

and Minnesota

Request an Appointment

Supporting copy for the Request Service

call out button.

PLANNING AHEADWITH ANNUITIES & RETIREMENT

START SAVING FOR YOUR RETIRMENT

Planning for retirement, whether that's five years away or 35 years down the road, is something each of us needs to do. Making smart choices about how much money you save, and what retirement planning savings vehicles you use, can mean the difference between having the income you need in retirement to live the lifestyle you want, or struggling financially. There is no one-size-fits-all solution when it comes to saving for retirement, but if you prefer a product that offers safety and guarantees, you may want to consider the retirement protection benefits offered by annuity products and indexed universal life (IUL) insurance policies.

WHAT ARE ANNUITIES?

An annuity is essentially an insurance product. With deferred annuities, the contract holder can accumulate money over a period of years (the "accumulation phase") by either making an initial deposit and watching it grow, or by making periodic deposits over time. Funds invested in retirement annuities grow tax-deferred. When you're ready to start drawing on your annuity, you "annuitize" the contract and turn it into an income stream so you receive a series of regular payments each month, quarter or year.

WHAT IS INDEXED UNIVERSAL LIFE INSURANCE?

An IUL policy is permanent life insurance coverage with both an insurance component and a cash value component. The cash value can be indexed to a financial market index, offering policyholders the upside potential that comes with investing in the markets while still retaining the protection of life insurance coverage.

WHY USE ANNUITIES AND IUL FOR RETIREMENT PROTECTION?

There are many reasons for choosing retirement protection annuities and IUL products.

The most common reason for using annuities is to turn your savings into a regular income stream during retirement. Funds from Social Security and pensions may not be enough to allow you to live the lifestyle you want when you retire. Choosing a retirement protection annuity can give you an additional paycheck every month to supplement those other income sources. This can give you the funds you need to meet your living expenses, travel, buy gifts for loved ones and more.

Best of all, retirement protection annuities can give you peace of mind without worrying about how you'll meet your monthly expenses.

Similarly, IUL policies offer you the option of accumulating cash inside your life insurance policy - cash that you can use for any purpose.

HOW DOES RETIREMENT PROTECTION WORK?

When you purchase a deferred annuity as part of your retirement plan, you enter into a contract with the issuing insurance company. During the accumulation phase, when you're able to add funds, your funds will grow on a tax-deferred basis. When you're ready to turn your annuity into a stream of cash, you'll have various payout options to choose from.

The first step toward ensuring you have the income you need during your retirement years is to contact Tricare Financial Services. We will help you understand the various products available.

CHOOSE TRICARE FINANCIAL SERVICES FOR RETIREMENT PROTECTION

We understand insurance and retirement products. Rather than trying to sell you proprietary products, we work with more than 15 insurance agencies to create custom insurance policies and annuity contracts for our clients.

We understand that everybody has a different financial picture, and different goals, so we never take a cookie-cutter approach. We will take the time to fully understand your families' needs, budget, and concerns so that we can find the perfect fit for you. At Tricare Financial Services, we are fully committed to protecting your life's journey.

FREQUENTLY ASKED QUESTIONS

Q: WHAT ARE THE ADVANTAGES OF RETIREMENT PROTECTION?

Many of the annuity and life insurance products available through Tricare Financial Services come with guarantees that can be invaluable to those concerned about not having enough retirement income from other sources.

The best part is that choosing a product with guarantees does not mean you have to give up the potential for growth in your annuity or cash value life insurance policy.

Q: DO I QUALIFY FOR RETIREMENT PROTECTION?

Most annuities used for retirement protection are "guaranteed issue" products that require no underwriting, so nearly everyone qualifies.

Because of the life insurance component of IUL policies, you need to meet the insurance company's underwriting criteria in order to qualify for the product.

Q: CAN I AFFORD RETIREMENT PROTECTION?

There are fees and expenses associated with any type of retirement planning vehicle, and retirement protection annuities and insurance products are no different. When you work with Tricare Financial Services to explore retirement protection options, we'll explain the fee structure of various products to help you make an informed decision.

Q: WHEN SHOULD I BUY RETIREMENT PROTECTION?

When you are saving for your retirement, the best time to buy retirement protection through annuities or life insurance is now.

Most annuity purchasers do so before they reach retirement age, or if they have a previous employee benefit plan to Roll Over. Annuity products often come with surrender charges for a period of time after making the initial purchase, so it's important to understand how each policy you are considering treats withdrawals, especially in the early years of the contract.

Because IUL has a life insurance component, the cost you pay will be based in part on your age at the time you purchase the policy. the younger you are, the more affordable the premiums are. This means you may be able to direct additional funds to the policy cash value to be used during your retirement.

Call 515-512-9750

Today for Your

FREE Policy Review.

Locally Owned and Operated

Helping since 2011

Helping You Choose the

Best Policy for Your Needs

Send Us a Message

Send us a message

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

About Us

Since 2011, Tricare Financial Services has been your choice for independent agents working with many different life insurance companies, so you have more options to choose from.

We only focus on life insurance and annuities. Our goal is to help you choose the best policy that suits your needs.

Service Area

Contact Us

205 Tradition Dr.

Polk City, IA 50226

Iowa / Minnesota: 515-512-9750

Nebraska: 402-935-8098

Privacy Policy

| Do Not Share My Information

| Conditions of Use

| Notice and Take Down Policy

| Website Accessibility Policy

© 2024

The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.